Shopify Taxes: 5 Must-Know Deductions to Maximize Profits

The thought of doing Shopify taxes is enough to make most merchant’s stomachs churn.

With so much to think about – from calculating sales tariffs to filing forms and correctly deducting expenses – It’s not uncommon for merchants to lose more than a night’s sleep over their eCommerce taxes.

But it doesn’t have to be this way. With a good dose of know-how, you can break free from the stresses of managing your Shopify taxes and rest easy knowing everything is under control.

We’ve teamed up with the guys at Free Cash Flow Agency to bring you this resource that’ll help you get a handle on your taxes.

You’ll learn from Co-founder Alan Chen (CPA) as he shows you proven techniques to avoid common tax pitfalls, comply with Government regulations and maximize the money you take home for yourself.

Sounds good? Let’s jump in!

The #1 Bookkeeping Mistake eCom Entrepreneurs Make

During April 2020, at the height of the COVID-19 pandemic, I was living a double life.

By day I was a CPA (Certified Public Accountant), and by night, I was immersed into the exciting world of online ecommerce.

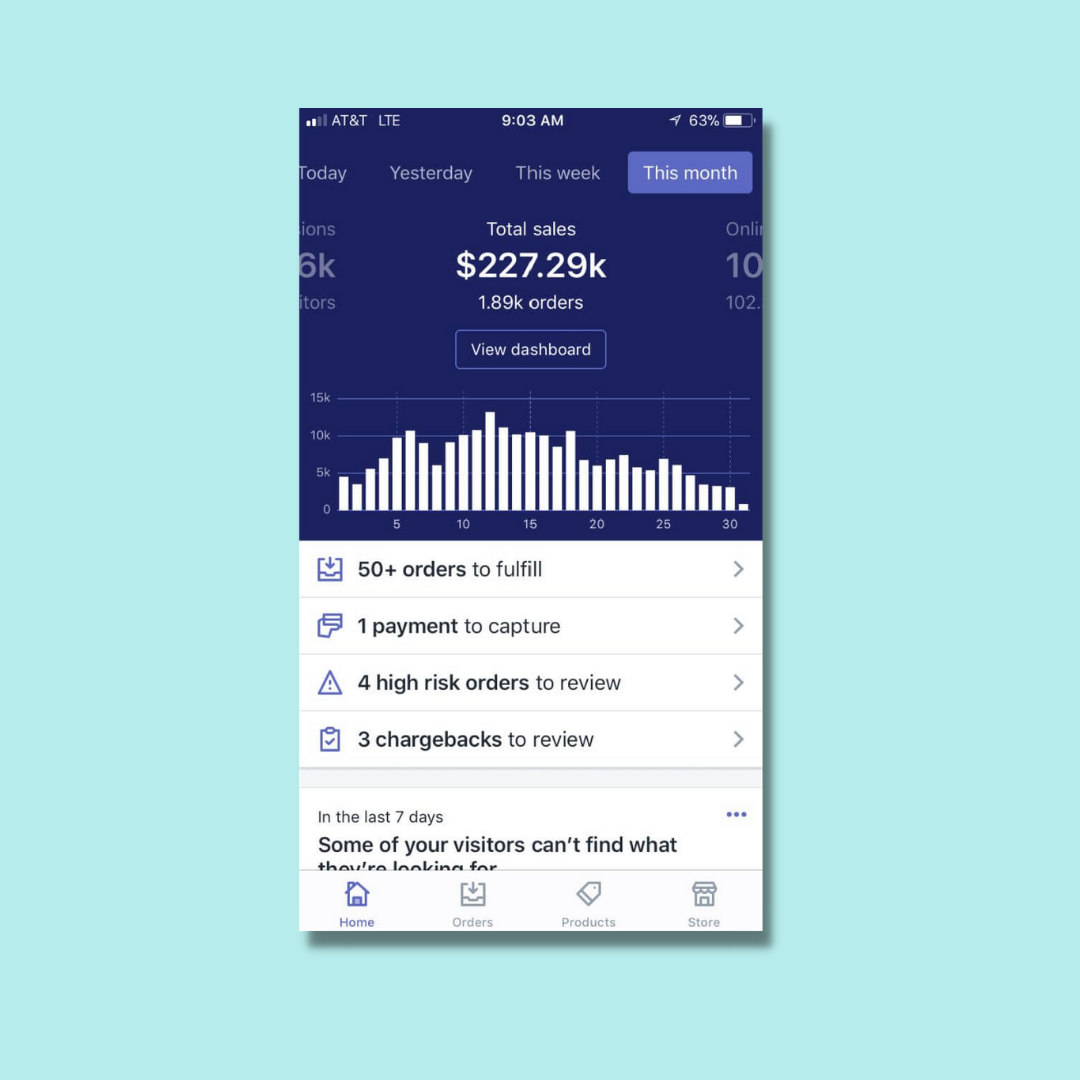

I was in awe when an entrepreneur would post crazy 6 -7 figure revenue screenshots like this:

However, many eCommerce owners don’t realize they’re making a critical mistake when they focus solely on top-line revenue.

Sure, huge screeshots are a great ego booster, but they don’t actually say much about how successful your business is.

What you really need to keep track of is your Net Profit.

Your Net Profit tells you how much cash hits your bank account after you’ve paid all your expenses (like your ad spend and product costs).

To calculate Net Profit, use this formula:

Revenue – Cost of Good Sold – Operating Expense = Net Profit.

Now For The Missing Piece of the Puzzle

Ok, so Net Profit is more important than top-line revenue. But there’s still one thing missing from the above equation…

Can you guess what it is? Here’s the complete formula:

Revenue – Cost of Good Sold – Operating Expense – TAXES (Federal, State, Sales Tax) = Cash Profit.

If you remember nothing else from this article, write down the above formula and reference it when making business decisions for your company.

Taxes in the United States come in many shapes and forms, but they can eat up to 40% of your Net Profit if you are not careful with your tax planning.

That means for a business that thinks it’s taking home $500,000 in profit; its actual take-home might only be $300,000. That’s $200,000 gone…just like that.

From our personal experience and conversations with hundreds of eCom stores, we realize how little education there was on ecommerce accounting and tax and the understanding of how impactful it could be if done correctly.

That’s why we put together this guide. Let’s keep going to discover how you can:

- Keep 15-20% more in profit this year for your business

- Ensure you know key tax deduction and credit, so there are no financial roadblocks or cash flow issues to keep your business from scaling to the moon.

Why Managing Your Shopify Taxes is Crucial for Success

Let’s take a step back and think about how you are keeping track of your bookkeeping right now.

You probably know how to navigate your Shopify dashboard and find your sales over a period of time:

That’s a great start!

Now, what about your Merchant Fees? Can you find out where to get those reports in PayPal and Stripe portal?

Caption: This is where you would get your PayPal Merchant Fees!

How about your ad spend? It’s important to know where to find the total amount of ad spend for your Facebook, Google, Pinterest, TikTok, and Snapchats ads.

Why am I asking you if you know how to track these figures?

Because, for an eCom business, these are tax-deductible expenses at a deductible rate of 100%! (More on this later)

But these aren’t the only things that are deductible. In addition, you can make large savings by tracking expenses in the following areas:

- Inventory or supplier report (Cost of Good Sold)

- Packing Supplies

- Salary expense or contractor cost (VAs)

- Shopify app cost

- Website Maintenance and hosting cost

- Business Travel

- Business Meals

- Conference and training expense

- State or Local Tax Paid

- Research and development expense

- Office rent or home office expense

- Spoilage or inventory loss expense

- Vehicle Expense

Tracking Expenses is the Key to Reducing Your Taxable Revenue

The critical point you need to understand here is that every dollar you keep track of (and show evidence for through a receipt/invoice) is another marginal tax dollar that can reduce your taxable income.

For example, A typical ecom profit and loss statement may look something like this:

(+) $2,304,231.22 Sales

(-) $799,923 COGS

(-) $400,321 Ad Spend

(-) $3,453 Email Marketing Software

(-) $34,223 VAs & Staff

(-) $33,221 Stripe/Paypal Transaction Fees

————————————-

$1,033,090.22 Net Profit/Taxable Income (Congratulations)

Not a bad year, right? But what if someone comes and tells you that they are taking close to 40% of that Taxable Income amount?

You’ve already worked so hard to get to this point, and by NOT maximizing your deductions, you’ll probably have to hand over a chunk of your hard work.

But what if you could actually save 15-25% more when it comes to your bottom line?

You can! When you track every dollar you’ve spent, you can slash the amount of taxable income! And why it is the foundational step to a successful and profitable ecom business.

🔑Key Point: Don’t skim on the importance of clean bookkeeping. Every dollar accounted for is another marginal tax dollar back into your wallet.

5 Ridiculously Simple Deductions for Shopify Taxes

Okay, what I’ve tried to drill through your mind so far is…

Tax Deduction = Dollar Dollar Bills!

A tax deduction is never going to give you up, let you down, run around, desert you, make you cry, say goodbye, tell a lie or hurt you. Rick knew best.

The IRS is also well aware of how much is left behind on the table each year. Take a look at this statistic from one of our course slides:

So, don’t be one of these guys, and learn to keep your hard-earned money where it belongs: in your bank account.

So we’ll take this chance to introduce the following essential ecom deduction you need to know to take advantage of the IRS tax code.

Shopify Taxes Deduction #1: Advertising Expense

The bread and butter of every ecom business is how they manage their paid advertising expense.

What’s important to know is that no matter if your adset is getting you 0.5 ROAS or 3.0 ROAS, they are BOTH tax-deductible.

Don’t be afraid to include every penny you spent on advertising on your schedule C form (more on that later).

It’s expected of an online business to have a large amount of advertising expense. You won’t run into issues with the IRS by reporting too much on eCommerce marketing.

💡Pro Tip: If you are looking for your Facebook receipts, you’ll find the instructions on how to download them here.

Shopify Taxes Deduction #2: Merchant Fee Expense

Merchant fees are an often overlooked ecom deduction simply because they usually get subtracted inconspicuously by your payment processor.

However, 3% of a $2M business is $60,000 in tax deduction you could be missing if you don’t account for it.

Make sure you can access your payment processor’s financial report portal and get an accurate Merchant Report.

Shopify Taxes Deduction #3: Home Office Deduction

“So the question we got at our agency often this past year is, I am working from home, what kind of deductions can I take?”

The good news is that there is a home office deduction that is available to all business owners!

To qualify for it, you must meet two requirements:

- ‘Regular and exclusive use’ – meaning whatever space you work in has to be for business use only.

- It must be the principal place of your business.

After you meet those two requirements, there are two ways to take this deduction.

- Simplified Option

- Actual Expense Method

Let’s explain each method a little bit more…

Simplified Option

The simplified method, as the name implies, is easy to claim:

You take the number of square feet you are occupying and multiply it by $5/square foot, and that’s your tax deduction amount.

The simplified option is capped at a maximum of 300 square feet, which means the most you can take is $1500.

We suggest using this method if you are a last-minute filer, as some deduction is better than none!

However, if possible, you should compare it to the Actual Expense Method below as that can net you a MUCH higher deduction amount.

Actual Expense Method

The Actual expense method is more involved. But it allows you to deduct direct expenses — such as painting or repairs solely in the home office — in full.

Plus, indirect expenses such as mortgage interest, insurance, home utilities, real estate taxes, general home repairs are also deductible based on the percentage of your home used for business.

So a real quick example:

Let’s say you paid:

- $5,000 in mortgage interest,

- $2,000 in insurance premiums

- $3,000 in utilities (all indirect expenses)

- Plus $350 on a home office paint job (direct Expense) during the year.

Your home office takes up 600 square feet in a 1,500-square-foot home, so maybe eligible to deduct indirect expenses on 40% of your home.

If you decided to use the simplified option, you’d be able to take a $1,500 tax deduction.

With the Actual Method, though…

- Home office represents 40% of the home (600/1,500)

- Apply the % to total indirect expenses ($10,000 x 40%)

- Add direct Expense of $500 for house painting

Now, you can take a $4,350 deduction, which represents a $2,850 increase in tax deduction!

For some of our clients who run a more extensive operation at home, we’ve been able to get as much as $24,000 in tax dollars with this one home office deduction.

How would you like that for your eCom business?

Shopify Taxes Deduction #4: Startup Cost Deduction

IRS (Publication 535) states that business owners can deduct $5,000 of startup cost for their first year of business.

So, what qualifies for startup cost deductions? There are three main areas of Startup Cost:

- Preparing the Business to Open – Examples: Travel overseas to talk to suppliers, consultant fees, etc.

- Creating a Trade or Business – Such as product research.

- Organizational Cost – Examples: Legal fees, accounting fees, state filings, incorporation, insurance

If you have incurred any of the above expenses during your first year of business, make sure to take advantage of this little-known “secret” deduction for ecom businesses you are running.

This is a unique deduction and one that will give you an extra boost of confidence as you start in your business this year.

Shopify Taxes Deduction #4: Bonus Depreciation

Last winter, we had a client who said they were afraid to expand their business because they were afraid of the heavy tax consequences.

They weren’t sure if they had the cash flow to foot their tax bill. We explained to this client that there’s nothing to fear.

The current post-pandemic environment has been very encouraging for small business owners. The government has provided a great deal of help and support for small business owners to grow their businesses in the US.

One of those guidelines comes in the form of powerful bonus depreciation. Congress created bonus depreciation as a way to encourage investment by small businesses.

Let’s recap how depreciation typically works.

Depreciation allows the user to take the tax deduction to reduce the value of an asset due to wear and tear over time.

Usually, the allowed approach is some form of straight-line method, so if you have a $100,000 asset and a useful life of 10 years, you can take $10,000 a year.

Well, with bonus depreciation, you can take an accelerated amount of depreciation the first year you purchased the item.

You used to be able to take 50% of the asset, but due to the Tax Cut and Jobs Act, that number is now 100%!

That’s right. You can completely write-off of the asset that you purchased this year.

The eligible assets that qualified for Bonus Depreciation are:

- Furniture

- Manufacturing equipment

- Heavy machinery

- Computer Software

- Qualified film & television productions

Note: Land and buildings do not qualify

But there’s more. Under the new laws, assets no longer have to be new to qualify for bonus depreciation. You can buy used assets.

Some other incredible fun facts about Bonus Depreciation:

- No annual limit on deductions

- Can be greater than your annual business income!

- The asset must be placed in service the year of.

Seriously, there is no better time than now to take advantage of bonus depreciation!

eCommerce Example of Bonus Depreciation:

Adam, who owns a fitness equipment brand, decided to start manufacturing his own custom-created new revolutionary weight-training equipment in the US.

He purchased collectively machinery valued at $1,500,000, and he is in the 35% tax bracket. How much tax savings can he receive under Bonus Depreciation?

Answer: For the 1.5M of equipment, he can deduct the entire equipment under the current 100% bonus depreciation ruling, which results in:

1,500,000 Tax Deduction X 35% Tax Bracket Rate

= $555,000 Tax Savings!

Essentially, he was able to purchase the 1.5M machinery for just $945,000, literally a 35% “discount.”

Now, Adam has more flexibility knowing that his investments will deliver the maximum tax savings.

💡ProTip: If you like to learn more about money-saving tax deductions like the one above, download our free ebook – 9 Most Crucial ECOM Tax Deductions The IRS Doesn’t Want You To Know – where we talk about even more game-changing tax deductions for your ecom business!

Should You Manage Your Shopify Taxes Yourself?

We often get questions at our company: At what point should I bring in an accountant/CPA to handle my Shopify taxes, and at what point is it better to manage it myself?

We typically break it down into three levels:

- From 0-100K in Annual Sales

- From 250-500K in Annual Sales

- 1M+ in Annual Sales.

Here’s our best advice for each level of business development:

From 0-100K in Annual Sales

For those that are 0-100K in sales, you don’t need to hire anyone yet!

You are just starting to grow your brand. At your revenue level, the difference between hiring a professional to perform your Shopify tax filing and doing it yourself would not yield significant enough savings.

I would take this opportunity to do your bookkeeping and tax planning, which will help you better understand your business’s financial standing and cash flow situation.

The following software can help you:

Recommended software for bookkeeping:

- Quickbooks Online – is one of the most popular bookkeeping programs in the world. There is somewhat of a learning curve to overcome, but they often a comprehensive training program.

- Freshbooks – has an intuitive UI for non-accountants to jump in and figure things out. Not as comprehensive in functionality as QBO but gets the job done at this level of revenue.

As you grow, we’d also recommend learning the accounting lingo and IRS terms so that you can navigate the world of accounting and tax with ease.

Plus, it might be helpful to take our ‘Tax-Free Ecom Course‘ – It’s designed with online entrepreneurs in mind to give them the tools and knowledge to feel more confident and save a boatload of money for your business at the same time.

If you are interested, we currently have a 20% discount for reconvert users. Use code “Reconvert-20” to get the course now!

From 250K to 500K in sales

Once you get past the 250K, the benefit of having a professional look at your finances becomes more prevalent.

The cost of missing tax deductions and credits is impactful, so I would consider getting at least on a consulting call with a CPA to do a thorough review of your business transactions.

A solid tax accountant will have an all-year approach, which allows them to:

- Better communicate with their clients on all key tax planning recommendations throughout the year

- Utilize advanced strategies to ensure merchants are using sales tax threshold to their advantage across all the states

- Stay informed of the merchant’s cash flow situation and analyze their trending gross margin and break-even ratio month over month

For 1M+ in sales

Once you get past the 1M+ mark, you should immediately seek the help of professionals to look over your bookkeeping and Shopify tax savings.

As you get past the 7 figure part, you start becoming more likely to be part of an IRS audit.

Now, you’ll want to enlist the help of a qualified CPA who understands your business to ensure your books are in order and your taxes are optimized to take advantage of your financial situation.

Remember, you could be giving away $50,000+ (or more) in Tax Savings when you are not optimized once you pass the 7 figure mark!

The worst thing is to give away any unnecessary money to anyone but yourself!

The 5 Most Important eCommerce Tax Forms to Know

Taxes and forms go hand in hand. Here are some of the most crucial Tax Forms you should be aware of as an eCommerce business owner:

- W9 Tax Form (Link here) – If you are looking to hire any contractors for your business and will be paying them more than $600 a year in salary, make sure to have them fill out a W9 form to stay compliant with IRS contractor guidelines!

- 1099-MISC Form (Link Here) – The 1099 Form is an annual filing (Due January of the following year) in which you must report the salary you paid each person (above $600) in rents, services, and other income payment that are not W2 employees of your company.

- Schedule C – (Link here) – This is the Profit or Loss From Business form designed for sole proprietorship and LLCs to report their business income and expenses. Getting familiar with this form is crucial to understanding exactly what deduction you can take for your business to maximize your tax savings.

- Form 1099-K – If you accept credit card payments in your business, you will get issued a 1099-K, Payment Card, and Third Party Network Transactions form, which reports the gross amount of all reportable payment transactions. It’s essential that your bookkeeping reflects your business income, and 1099-K is a 3rd party “check-up” to ensure your reported income at least covers what a 3rd party payment processor believes you should have collected this year. Typically you will receive this form from Stripe, Paypal, and Shopify Payments.

- Form 8824 – (Link here) – “Like-Kind Exchange”- is an essential form as it reports capital assets that you exchange for another capital asset of a similar nature without generating a taxable event. In other words, it is a genius way to defer taxes while disposing of your assets at the same time. Yes, you can even exchange one ecom business for another!

Go Forth & Make Shopify Tax Savings!

Hopefully, this has given you a taste of how powerful proper bookkeeping can be for your Shopify taxes.

I would like to end this article with three key takeaways you should be thinking about for your ecom business:

- Learn the key tax deductions and credits for your business, so you don’t give away your hard-earned cash to the government!

- Tax Planning is a year-round event- hire a CPA that understands your business and will be there with you 365 days a year to answer your questions!

- Start early and educate yourself on all the business strategies and tax advantages you should be utilizing to catapult your business to the next level!

Bookmark this article and let us know in the comments below when you realize how impactful it is to have the proper tax and accounting knowledge for your scaling business. We would love to celebrate your tax savings with you!

We can’t wait to see you all out there take your brand and your passion to the moon!

Want to Learn More About Managing Your Taxes?

To celebrate our partnership with Reconvert.io, we’d like to offer readers 20% off (limited to the first 50 Students) our eCommerce Tax course -‘Tax-Free Ecom‘. Simply use the code “Reconvert-20” when you sign up. Grab it, learn it, and increase your tax profit by 15-20% today!

Author Bio:

That is a guest post from Alan Chen (CPA). Alan is the co-founder of online accounting firm Free Cash Flow Agency which helps eCommerce merchants navigate the confusing world of bookkeeping, maximize their tax savings, and put more hard earned dollars in the bank – exactly where they belong.

.png)

.png)